Have I got an investment opportunity for you. You’re going to thank me for this one.

Before I begin I want you to grab a piece of paper and a pencil and write down some important facts about this investment.

I guess the first thing you’ll want to know is how to classify this investment. Is it real estate? Is it a stock? Is it a bond?

It’s actually none of the above. It’s unique! But if I had to compare it to something I would compare it to high yield bonds (aka junk bonds.)

The next question you’ll probably want to know the answer to is what’s the expense ratio? For we all know that when investing “you get what you don’t pay for.”

And the answer here is that the expense ratio is 1%.

Another thing you may be wondering is what is the historical performance of this asset class ?

And the answer to that one is: I don’t know. The history of this asset class is less than five years old.

You may also be concerned as to how liquid this asset is. (I.e. if you want to get out of this asset after buying it will you be able to do so at a fair price?)

And the answer here is that the resale market is quite opaque and it’s unclear what the bid-ask spreads are (the difference between how much you must pay to buy a loan and how much you would get if you sold it at the same time.) And in general such nontransparent markets are good for only one group of people: the brokers.

It’s always a good idea to ask whether or not there is risk present in this investment that can be diversified away.

And the answer here is that there’s a boat load of diversifiable risk (remember this a the type of risk that you don’t get paid for.)

So let’s sum it up: my golden investment opportunity is like an illiquid junk-bond, with a high expense ratio, an extremely limited history, and loads of uncompensated risk.

Any takers?

Don’t everyone sign up at once

So what asset class am I talking about here? I’m talking about the darling of so many bloggers: peer-to-peer lending. (You’re probably familiar with P2P firms like Lending Club and Prosper.)

I first read about this asset class on the Mr. Money Mustache blog. And like most of his posts after reading about his experiences, I was inspired to look into it for myself.

It’s attraction was obvious. It started with the premise of being paid interest at a greater than 10% rate for high-risk loans. Plus there was the whole crowdsourcing feel of the project. You the lender were just a dude with some money who was lending another dude without money some money! Screw Wall Street, we can do it ourselves!***

But the more I thought about it more I began to see that this asset class was nothing more than a new form of hyper-junky junk bonds.

As you may know,a junk-bond is a debt instrument that allows you to collect higher interest rates (yield) by lending your money to corporations with poor credit ratings. Which makes sense on a certain level. After all risk and reward are inextricably linked in the market. So why not take a little risk with your debt purchases in exchange for a higher yield?

Or to phrase it another way, if risk is rewarded in the markets, why not choose to invest in junk bonds?

To answer that question, one must first answer the question, why invest in bonds at all when long-term equities are expected to have higher returns?

The main purpose of bonds in a portfolio, as I see it, is not to increase yield. It is to provide a counterbalance to the risk of equities. So when the next financial crisis occurs and equities lose a significant portion of their value, some wealth will be preserved (or even increased) in the bond bucket which can then be used to buy cheap stocks during the next rebalancing.

The best thing about treasuries is that they tend to do well precisely when Stocks do poorly because at times of crisis, money flees to safety. To me that is the real purpose of owning bonds in a portfolio. The interest income is nice, don’t get me wrong (and the more of it that you can safely claim the better,) but it’s not central.

Which brings me back to junk bonds. Junk bonds behave like hybrid mixtures of bonds and equities. They have higher yields than bonds (though their returns are generally not as high as equities.) More importantly they also carry much more risk than investment grade bonds. And unfortunately, the risk shows up at the worst possible times. They tend to lose their value quickly in times of financial crisis when stocks also plummet.

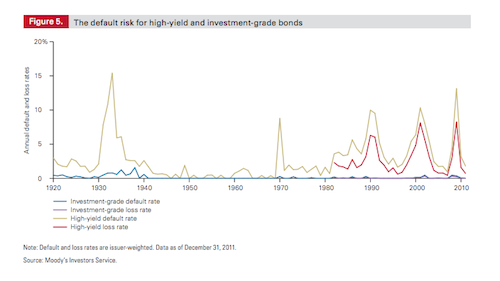

Notice any patterns as to when junk bonds have high loss and default rates?

Notice any patterns as to when junk bonds have high loss and default rates?

Larry Swedroe covers this well in his book on bonds, but this article does a nice job of hitting the high points on the equity-like risk of junk bonds.

But wait, it gets worse. It turns out that although yields are undeniably higher on high-yield bonds than on safer investment grade bonds, it is often the case that the credit risk (or the risk of default) is not adequately compensated for by the increased yield. In other words there’s more risk, but when the total returns are calculated, often not more reward.

This article by William Bernstein and Vanguard nicely points out the unique risks of high yield bonds, and investigates whether or not their inclusion in a portfolio offers a diversification benefit. (Spoiler alert: the answer is probably no when all of the costs of such investments are tallied.)

So that’s why I have no interest in investing in junk bonds.

And I plead guilty to using a bit of misdirection here. After all I’m supposed to be talking about peer-to-peer lending not about junk bonds right?

In my defense, It turns out that when I subconsciously relate junk bonds to peer-to-peer lending, I am actually being quite charitable to peer to peer lending with this comparison.

In this brilliant article from the oblivious investor, (which I urge you to read) he points out that investing in a high-yield bond index fund is actually far preferable to participating in peer-to-peer lending.

Why? Because compared to peer to peer lending, a low-cost high-yield bond index fund is

- Cheaper

- Better diversified

- More liquid

- Cheaper to liquidate

- subject to a lower default risk

- Less subject to company specific risk (I.e.Don’t forget to consider the risk of what happens to your money when Lending Club goes bankrupt.)

And the cherry on top of this delicious P2P investment sundae is that the interest paid through Lending Club is taxed as ordinary income. (so if I were to make 10 bucks through lending club I would only get to keep five of them.)

Which is why whenever I read an effusive post about the promise of Lending Club, or Prosper I find myself searching for the nearest 10 foot pole.

To each his own, I suppose. But just because you like a blogger, (and I love both MMM as well as the White Coat Investor who also dabbles in P2P lending) it doesn’t mean you should blindly follow all of their investment advice. Even if the blogger is me.

*** never mind the fact that there’s a non-Wall Street banker skimming a 1% expense ratio off the top of this interest…

3 Responses to “Sacred Cows”