If I were entering college today, knowing what I know now, I would mix in a few economics classes.

At the time I started college, my perception of economics was that of a boring pseudoscience practiced by technocrats. It was a field for bean counters and for those without imagination or creativity.

I was interested in science, and literature, and philosophy….and drinking and girls. (Not necessarily in that order.)

But I certainly never gave economics a second thought.

The more I’ve become exposed to this field, however, in passing on the radio, and in my pleasure reading, The more it seems to me that that this is where real philosophy resides.

For money lies at the heart of everything.

It is how we keep score, and its reach and power are irrefutable.

It’s what separates the first from the third world, the oligarchs from the proletariat, and the haves from the have-nots.

If we want to measure how successful an academic is, how much grant money she gets is a good place to start.

University leaders are also distinguished by their abilities to fund endowments.

As for politicians The ability to stay in office is almost directly linked to their ability to raise funds.

If we want to find out what’s really going on in any given situation, it’s always a good idea to “follow the money.”

And the way that we deal with money individually and societally is profound. It reveals so much about who we are.

Which is to say that no matter what, on some level, it is always about the money.

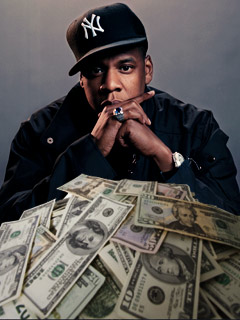

Who am I to argue with Jay Z?

Or is it?

What got me thinking about all this was a recent post, where I made this claim about saving for early retirement : “It’s not about the money.”

That statement, and a comment that I received about it afterwards, got me thinking about this relationship between saving money and the pursuit of early retirement.

What was I getting at when I made that statement?

I can’t be sure but I’ve come up with two possible theories.

Theory number one: “It’s the freedom stupid.”

What got me going on this whole early retirement kick in the first place, was the paradigm-shifting idea that money was not merely a commodity to be exchanged for goods.

This crucial realization came about when I first understood relationship between one’s savings percentage and one’s time horizon to retirement.

That relationship showed me that the central decision was not really to “spend or not to spend .” The decision that I had to make each and every day was whether I wanted to spend my money on commodities, or to invest my earnings on my own freedom.

Once this stark choice presented itself, my own core motivations became obvious to me. My thirst for freedom was much more powerful than my desire for almost all material possessions.

Theory Number Two: Saving Money Is A Means Not An End.

The second thing that I was trying to say when I proclaimed “it’s not about the money ,” was really a whispered warning to myself.

In admitting that it did bother me that I would not be able to fully participate in “catch up” contributions, (because I would already be retired) I saw in my own attitudes towards saving another danger, and one potentially as destructive as the habit of thoughtless spending.

As discussed in theory number one, saving money, for me, is really about procuring freedom.

But once I started this journey, I happily found that getting wrapped up in saving my own money, and figuring out the best way to invest it, was really no sacrifice at all. It was all surprisingly fun.

The saving in and of itself felt like an almost religious act.

And investing was every bit as entertaining and addicting as gambling.

Even figuring out clever ways to avoid taxes legally became a gleeful diversion for me.

My own discomfort at (possibly) not being able to participate in “catch-up” savings alerted me that my saving habit could become it’s own trap.

As ridiculous as it sounds, it seemed possible suddenly, that I could eventually become so addicted to saving, that it would force me to turn my back on the seminal pursuit of my own freedom.

Which from any angle would be silly, and stupid, and backwards.

My idea of a life well lived is certainly not dying on a big pile of money, that’s for sure.

It is a life filled with close relationships, particularly with my family.

It is a life spent following my own bliss.

It is a life spent constantly learning new things.

It is a life of physical activity and mental stimulation.

It is a life replete with creativity, and beauty, (and good food.)

It is a life where I am making a difference in other peoples lives.

Freedom is the destination. And Early retirement is just the horse on whose back I’m clinging in a desperate effort to get there.

Early Retirement and me as a boy…

And the money, on some level, is just another distraction.

2 Responses to “All About the Benjamins?”