Budgeting is all about deciding which things are worth blowing your dollars on, and which things are not.

On which things should you spend your stash? And where should you invest your disposable income in order to maximize your own happiness?

These are important and complex questions, and the calculus differs for each individual.

Some will blow their money on travel. Others on cars. Others on home furnishings. Others on concerts. Others on dining out.

In fact, one of the great benefits of having a budget is that it allows you to focus on that which is truly important to you, and ignore the rest. In this way budgeting very efficient.

My budgetary priorities? Merlot, Marlboro’s, and tanning cream.

But one investment that is surely worth considering is education.

I think most parents would agree that getting their children the best education possible is of primary concern.

Now for some this may mean homeschooling, for others public schools, and for others yet, elite private schools.

But there’s no getting around the value of a good education.

It opens doors to financial security. It raises the floor on achievement as well as the ceiling. It teaches us socialization and networking. And it gives us the tools to think critically.

Which brings us to 529’s.

529 is, of course, a section of the IRS tax code which legislates college savings accounts.

A 529 is an education savings account, usually administered by a state, which allows for parents, grandparents, or students to save up money for future education expenses of themselves or family members in a tax advantaged manner.

There are really two main benefits to saving money in a 529.

1. Tax efficiency.

As long as your invested money is used for qualified education expenses it can be pulled out tax-free at any time (from both federal and state taxes.)

So unlike taxable accounts, capital gains, dividends and appreciation are not taxed at all, for qualified expenses.

In this way a 529 is not unlike a Roth IRA. You put in after-tax money and your profits and principal are never taxed from that point forward.

2. Tax deductions and tax credits.

In many states you’re also given a tax credit or a tax deduction up to a certain contribution each year.

As an example in 2013 my home state of Oregon made the first $4455 contributed to a 529 tax-deductible for state taxes. So at the top marginal tax bracket of 9.8% this would mean almost $437 saved in a year.

Not bad.

So when should you contribute to a 529 plan?

My approach has been to contribute to a 529 (at least up to the level of my state tax credit/tax deduction) after I have accomplished the following.

1. Maximized my employer-based retirement accounts.

2. Maximized contributions to a health savings account.

3. Maximized contributions to a backdoor Roth IRA.

Why am I placing my children’s college education below my own selfish retirement goals, you ask?

Well, for a few reasons.

1. There are many ways to pay for college, including scholarships, financial aid, student loans, and postgraduate service programs.

2. I’m going to pay for my kids’ educations one way or another.

3. I have no expectation or desire for anyone else to help me and my wife pay for our retirement.

4. The tax advantages of a 529, while very good, are not overwhelming.

As evidence I would encourage you to read this recent article from The Whitecoat Investor about just how beneficial 529’s are.

From which you will learn that The benefits of a 529 are proportional to the following factors:

1. The initial tax credit/deduction.

2. The percentage return on your investment. (The better your return, the more beneficial a 529 is when compared to a taxable account.)

3. How low the fees are to invest in the 529 that you select.

Which means that the low hanging fruit is harvested by contributing up to the level at which you take a tax break, and in proportion to the aggressiveness of your portfolio.

So I would:

1. Focus on contributing up to the yearly tax-deductible amount.

2. Invest the 529 money very aggressively.(I.e. invest almost all of it in high-risk/high reward Stocks.)

and

3. Only invest in a 529 with sufficiently low fees. (Expense ratios less than 0.5%; and the lower, the better.)

So which are the best 529 programs?

You guessed it the ones with the lowest fees.

This article reported the five lowest fee funds for 2013.

But I am inclined to agree with The White Coat Investor, once again. Utah does have the best plan. In addition to offering Vanguard funds both domestically and internationally, it also offers DFA funds which are generally only accessible through a financial advisor. (AKA a big party favor for personal finance geeks like me.)

So while I don’t envy The Whitecoat Investor his difficulty in purchasing alcohol on Sunday in his home state, I do envy him Utah’s 529 plan (and his local ski options.)

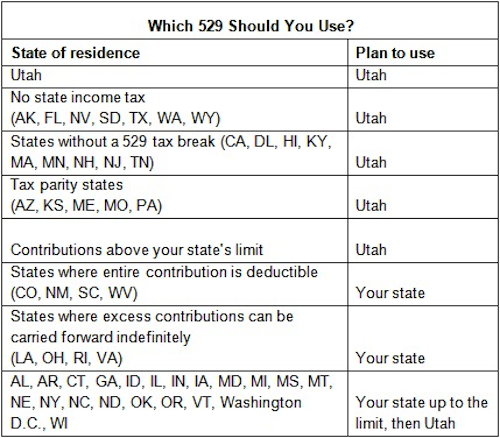

And If you’re wondering where you should place your 529 money, I found this chart particularly useful.

Courtesy WCI

But a quick note from the travel hacking hemisphere of my brain. I actually wouldn’t select Utah’s 529 for additional contributions after maxing out my home state’s tax deduction.

I would choose New York’s.

Why? Because I can contribute to New York’s plan with credit cards using evolvemoney.com (which would of course provide me with an additional 4% risk free return at the point of investment in the form cashback on the purchase of giftcards.)

And as you know, I am all about free lunches.