Have I got a terrific story about dual momentum, and how it works, and why it works.

I’ve told this story in bits and pieces before, but it’s high time that I gave you my full explanation for why I think that dual momentum works, uninterrupted and in excruciating detail.

The good news is that I’m going to give you that story right here and right now.

The bad news is that I am also going to argue that you should probably just ignore my story, because it doesn’t mean much. Oh and you should also probably ignore the story that you use to justify whatever investment philosophy that you are using right now. That doesn’t mean much either, in my opinion.

But enough prologue, let’s get into the meat of the matter.

Why dual momentum works

Dual momentum is actually not a single story. As the name implies, it is two separate stories told simultaneously and blended together into one. Those two stories Are those of “relative momentum” and “absolute momentum.”

Relative momentum

When people talk about momentum they are usually talking about relative momentum. This market anomaly stems from an empirical observation that assets that have performed well in the recent past (between 2 and 15 months) will tend to continue to perform well in the near future (the coming 1 to 2 months.) This simple observation has proven to be very robust, in that this tendency has been demonstrated in all market types , in all time periods studied, and has persisted unabated long since it was first described by Jagadeesh and Titman in 1993.

But we’re not discussing empirical observations today. We’re talking about stories. In other words forget that the sun has risen every day for millions of years, what we want to talk about now is why the sun rises every day.

In my view, relative momentum is primarily a behavioral story. Efficient market types will of course try to squeeze the momentum anomaly “toothpaste” into the risk story “toothpaste tube,” and will continue to sound foolish in doing so.

Not to put too fine a point on it, but in my view momentum is simply quantitative evidence of human beings’ inexorable tendency to chase performance.

Think about the first time you had to make an investment decision. Perhaps you were selecting a fund for your first 401(k)? And maybe you didn’t know very much about investing. But there they were; a long list of funds, and a bunch of columns of data. What did you look at first? I’m guessing that one of the first things that you were drawn to, like a moth to flame, was the past performance for the various funds listed. I know that was the case for me.

But eventually you probably figured that your first instinct wasn’t the smartest way to choose a fund, and that there were bound to be smart people out there who had written books to help you learn how to invest.

So you probably picked up some books to read, or maybe you read some blogs, or talked to a financial advisor (you didn’t know any better at the time.)

And there were a lot of different stories to choose from. You could’ve attached yourself to a value approach, a technical trading approach, a growth approach a dividend growth approach,or a momentum approach, to name but a few.

And whoever delivered the argument for the approach that you eventually adopted was probably a smart guy with a good story.

For me the most compelling story was that of index investing. It was a story of an efficient market that continually grew. There were lots of smart people trying to beat the market, but the smart people generally canceled each other out, for each time someone sold something, someone else was buying. In other words it was a zero sum game. And since so many smart people were playing it, it was very hard to be consistently above average. So in the end the best you could reasonably hope to do was to match the market minus fees. (Which meant that keeping fees low was of paramount importance.)

It was a compelling story. And it was a story well told in my case by authors like Larry Swedroe, William Bernstein, Jack Bogle, and others.

But the most convincing part of the story itself, was the proof that was in the pudding.

Over long time horizons (say 10 years or longer) the broad market (and its surrogate, low cost passive index funds) consistently beat the active traders participating in it to the tune of a whopping 80 percent of the time. And most of the 20% of investors who had beaten the market had an outperformance that could be entirely explained by simple luck.

Worst of all for the active crowd, The traders who did beat the market did not deliver their investors enough of a return over the market to justify the risk that the investors had taken (to the tune of an 80% probability) of underperforming the market.

To be sure there were some truly skilled investors. The Warren Buffett’s and Paul Tudor Jones of the world who outperformed the market in a manner that was very difficult to explain by randomness or luck. But these savants were only recognizable in retrospect, so searching for the next one was a sucker’s play.

So all in all it was a good story, and one that I still believe in, even though I’m not much of a passive indexer anymore.

But in all honesty I think the story was largely irrelevant. What had really convinced me was the data itself.

Put another way, if active investors had consistently beaten the market 8 times out of 10, and if Vanguard funds had consistently underperformed their active counterpoints, would I have cared what story Jack Bogle had to tell me about the market? Would I even have known who Jack Bogle was, or Larry Swedroe, or William Bernstein?

Obviously not.

Because it wasn’t just these guys who had convincing stories. Everyone had a story. About risk premia, or human behavioral biases, or about pathognomonic shapes in stock charts, or about intrinsic value, or company specific growth potential.

But in the end the proof was in the pudding.

(Proof lies herein)

We only listen to stories that are validated by empirical observation. (And we are wise to engage in this selectivity of survivorship bias: Who in their right mind would ever listen to a homeless man telling them how to become rich?)

Put another way, even if you are a true blue believer in the efficient market hypothesis and passive investing, the main engine for your belief was probably driven by performance chasing.

Still not convinced? Do you still think that is the underlying logic of your chosen investment strategy that informed your decision to choose it in the first place?

Then please answer this question….

John Bogle started the first passive investment trust in 1975. Since that point he has basically been telling the same story over and over again. His logic has been sound and unchanging. But if it was the Eureka realization of his logic that informed his future success, then shouldn’t the world have been convinced upfront?

Shouldn’t there have been a massive conversion towards passive investment once a passive investment vehicle was offered to the market at a fair price? After all humans are almost certainly no more intelligent now than they were in 1975.

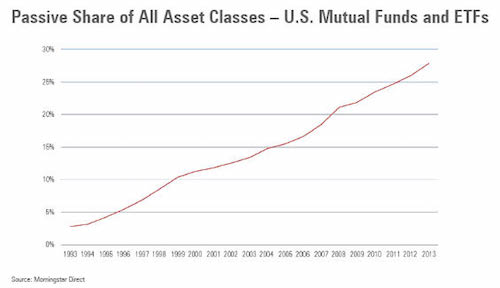

But let’s look at how this dramatic movement of dollars towards passive investment actually occurred.

(It took almost 20 years for passive investing to get to a 3% market share!)

It was a gradual conversion, not a mass conversion (to say the least!) And I don’t claim to know why that was, but my best guess is that over time Bogle’s hypothesis was born out by the data and this slowly convinced people and institutions to move their money towards his winning manner of investing.

The winning story of passive investment spread because passive investment just kept on winning.

All of which makes the inexorable performance chasing tendencies of human beings a good enough foundation upon which to rest an investment strategy, if you ask me. (Not that you should.)

In my conception of relative momentum each trade or investment decision made by a person is subtly affected by the inescapably human tendency to chase performance. So perhaps we are a little bit quicker to buy recent winners and a little bit slower to sell them. And perhaps we are a little bit slower to buy recent losers, and a little bit faster to sell them.

And on an institutional level transactions occur much slower as funds move away from losing funds and towards winners. This latency is caused by the inherent cost of moving large sums of money, and the constraints on moving large amounts in and out of funds (Agency effects, contractual obligation’s etc.) These constraints at least partially account the unchanging timeframe of price momentum (3 to 15 months.) (This observation about institutional agency effects perpetuating momentum was originally put forth by a group from the London school of economics.)

So the take-home message is here that, at least to me, performance chasing and human irrationality form a coherent story about why price momentum exists.

But this coherent story is probably irrelevant, since the only reason I’m telling it is because momentum exists it has been proven to persistently increase returns over the broad market in a robust and convincing manner.

So that is one half of the (irrelevant) dual momentum story. A story about how human beings have a basic tendency to chase performance, and how this creates reproducible price momentum.

But what about the other half of the story. What about the absolute momentum story?

Absolute momentum

Absolute momentum (or time series momentum) is really not a momentum story at all. It is a trend following story.

Trend following, is a form of technical analysis (a dirty word in academic circles) that posits that we can get valuable information about future returns based on past returns. It ignores fundamental information about value and simply focuses on the simple patterns of price movement.

It’s justification is largely behavioral, namely that humans partially base buying and selling decisions on illogical determinations of relative value.

And while such a justification might sound pie in the sky or soft at first blush, there is a wealth of data to suggest that such behavioral tendencies have existed and continue to exist in us humans to this day.

(Again if you haven’t read Thinking Fast And Slow yet, shame on you! It’s a hugely important book that sheds light on the strange ways in which we humans actually make decisions.)

A couple of the key heuristics that support the philosophy of trend following:

1. Anchoring: our human tendency to irrationally judge value based on the known value of statistically unrelated items.

2. Recency: our tendency to over emphasize the importance of events or information (eg prices) in the recent past, and to under emphasize the significance of more distant events.

Trend following can take many forms. But the overlap with momentum is fairly obvious. If you follow trend you will generally buy winners and sell losers, since doing the opposite would run counter to both momentum and the trend.

I would group both absolute momentum and long-term moving average rules under the same umbrella since they both attempt to do the same thing.

When a stock’s (or index fund’s ) price falls below the 200 day moving average or when a stock’s (or index fund’s) returns fall below cash returns for a preset look back period of 3-12 months then the message is basically the same: The stock, (or index fund) that is being followed, is in a bear market, and it would be wise to liquidate your position into a safe asset until it starts growing again. In other words both of these approaches are just ways recognizing and exiting bear markets in a timely manner, once they have started.

And obviously both approaches have worked in the past or we wouldn’t be talking about them now.

Test these approaches in any market for any lengthy time period and you will get remarkably similar results: markedly diminished drawdowns.

So the question is obvious: Why should these approaches work? In other words what guarantee is there that just because bear markets have looked a certain way in the past, they will continue to look that way in the future?

There are no guarantees. And there is an example in the past where these approaches have not protected its practitioners from feeling the full brunt of a market downturn (The flash crash of 1987.) and there is no reason why whipsaws cannot randomly happen in the future.

But there is reason to believe that future bear markets will continue to look enough like past bear markets that trendfollowing approaches will continue to almost always work at mitigating draw downs.

Why do I say this? Because when we are talking about large scale expansion and recession, we are talking about the business cycle. And when we are talking about the business cycle we’re talking about the movements of a large economies. And large economies are like battleships, not Jet Ski’s. They cannot turn on a dime.

It takes time for bubbles to inflate. And it takes time for risks to work their way through a system. And when an economy begins shrinking, it takes time to for those in power to recognize that it is in fact shrinking. And when second order actions occur, and interest rates are dropped by central banks, and stimulus bills are passed by governments, it takes time for the pain to work its way through the system, and for the corrective actions to have any effect at all.

And past a point, no matter how long the bear market lasts, for the remainder of the draw down, the trend follower will outperform the broad stock market which will continue losing value even as the trend follower’s portfolio is sitting in safe assets.

So a bear market really cannot be too long. It can only be too short for a trend follower.

And how short is too short? A draw down is too short if only short-term treasuries do not outperform the risky assets for the lookback period in a dual momentum portfolio prior to the beginning of the next market recovery.

And note that in this instance the trend following approach does not underperform, it merely fails to outperform.

The only real problem arises when there is a very rapid drawdown followed by an immediate and slow recovery, as was the case with the Flash crash and recovery following Black Monday in 1987. Such an occurrence is a scary prospect for this approach, but it’s also been a very rare occurrence historically.

So when you combine the business cycle scale effects that make it very unlikely for future bear markets not to last for similar time frames as in the past (or longer,) with a strategy that is very good at recognizing bear markets as long as they do not occur too quickly, you have a compelling argument for why trend following should remain robust in its ability to diminish drawdowns long into an unknowable future.

(One could even argue that this form of trend following is “anti-fragile” since it thrives in comparison to other strategies when market conditions become random and negative. )

But in the end this too is only a story, and like most stories it is only being told because it describes past successes.

In the end none of us knows what will happen in the future. Not Jack Bogle, not Warren Buffet, and certainly not you or me.

It all ends up being a probability play in an inscrutable world of randomness and unpredictability.

And all we have to help us as we choose where to put our pennies down, are the recordings of past events, and pretty stories to make us feel better about our decisions after the fact.

11 Responses to “Bedtime Stories”