It’s no news that I’m a huge fan of the white coat investor.

James Dahle MD is, quite simply, one of my favorite bloggers.

Which is funny, because in many ways, he is the antithesis of who I am.

You have witnessed before my feeble powers of mathematics. My outsized confidence in my own mental mathematical abilities is only outdone by my obvious incompetence at actually running numbers in my head.

Although Dahle is a doctor, just like me, he seems in many ways to be more of an actuary in physician’s clothing.

He’s the type of guy I picture running Excel spreadsheets at his 10th birthday party, in order to figure out the best back tested way to invest his birthday dividends (he obviously asked for money for his birthday, not a baseball glove) in order to achieve financial independence prior to his sophomore year in highschool.

James Dahle’s favorite videogame as a boy…

And I’m pretty sure that on those nights when I drink an Imperial IPA with dinner and pass out on the couch after putting the kids to bed, James is running excel spreadsheets to figure out ways to make his portfolio more efficient.

I fancy myself an ideas guy. A philosophy guy. A motivation guy.

But when I’m researching the specifics of an idea for a post, I often scour the whitecoatinvestor.com for details, prior to waxing poetic.

And I’m pretty sure that the converse is not true.

Which is all a ham fisted way for me to say that this guy is legit. He’s a reasoned thinker on all things financial. He’s a wiz with spreadsheets. He’s been thinking about this stuff deeply for a long time. And despite all of that he’s a very good writer.

Which brings me to his new book, The White Coat Investor; A Doctor’s Guide To Personal Finance And Investing.

In between emergency room shifts, and pumping out blog posts, Dahle has written a concise and readable treatise on financial planning for the physician.

The results are an original, and well-documented blueprint for how to achieve wealth as a doctor.

But very little of this information is specific to doctors.

His advice is perfect for other high-income earners, like lawyers, engineers, etc. but it is also very useful to lower income earners.

For at it’s core sound financial advice is all the same: spend less, save more, invest wisely (ie passively,) avoid taxes, and insure against disaster.

Here then are five concepts from the book that taught me something cool.

1. Live like a resident:

Dahle makes a meticulous and compelling case for living well below your means during your first five years in practice.

This is an elegant solution to the particular financial trajectory faced by doctors. A late start to their careers, lower than average earnings and higher than average debt early in their lives, and generous salaries in their middle to old-age.

But I think there is relevance to this message, even for non-doctors. This is a clever approach to avoiding lifestyle inflation. Being disciplined as a young person builds up important financial muscles that will serve you well and set you up financially for success later in life.

2. Don’t stretch to buy a house when young.

Dahle makes a compelling case for not buying a house early in your career.

Granted this is a case much easier to make in the post 2008 landscape, but as usual his argument well laid out and documented with instructive specifics.

3. Realize that once you stop working, and your mortgage is paid off, your costs of will be greatly reduced.

This is a point that I made previously in this post. But as usual, Dahle has outdone me.

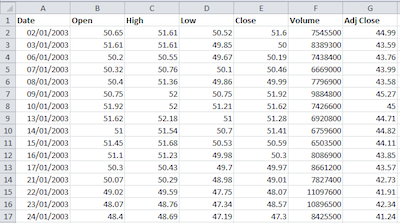

In particular he has a nifty spreadsheet on page 81 that lays out the differences in the costs of living for a working person and a retired one collecting Social Security.

4. Be very careful when choosing a financial advisor.

It seems that the flipside of being a financial savant at a young age, is that you can fall prey to unscrupulous financial schemes as a young man.

Presumably because of his experiences, Dahle does a great job laying out the lax qualifications and rife conflicts of interest that plague financial advisors, and guides you on how to pick an appropriate financial advisor, should you so desire a helping hand with your investments.

5. It’s never too early to think about estate planning.

Dahle does a great job laying out the landscape and the hazards of passing on wealth to your heirs.

This is an area that I need to bone up on, and his chapter on estate planning gave me a great place to start.

So, all in all, my feeling is that this is a fantastic book, and would be a particularly appropriate present to give to a graduating medical or law student or a medical resident.

It would also be a handy book for you to have on your bookshelf at home, regardless of your profession.

So if you want to continue to be motivated to improve your financial position, keep on coming here, but if you want the granular details on how to get from point A to point B, you can do no better than The White Coat Investor.

But wait, there’s more: Dahle was kind enough to give me a copy of his book to give out as a prize to one of my readers.

If you would like to receive a copy of the white coat investor, just leave a comment below on how this book would be of interest to you, or further subjects that you would like to be discussed in this blog.

Or leave a humorous comment.

I will send a copy of the book to my favorite comment’s writer!

10 Responses to “Book Club and Free Prize!”