The miles game continues to steam along month after month.

There’ve been no dramatic changes to my approach of late but there’ve been some subtle changes that are worth reporting on.

My current approach involves:

- $1000 “spent” in Amazon payments a month between me and my wife’s account.

- One Isis serve card for both me and my wife.

- One PayPal business MasterCard debit card for both me and my wife.

- 2 credit card applications a month for both me and my wife.

- Between $4-5000 worth of moneypak cards purchased with credit card at Riteaid and loaded onto each of our isis serve cards via online loads.

- Between $2-4000 worth of PayPal mycash cards loaded onto our PayPal accounts each month via the Internet.

- $1500 a month each loaded from PayPal onto both of our Isis Serve cards via automatic debit using our PayPal business debit cards (at 1% cashback.)

- $1500 a month each loaded automatically from our credit cards onto our Isis Serve cards.

- Liquidation of our Serve accounts via withdrawal of the end of month account balance to the bank.

- About $2500 a month of stock purchases for both me and my wife via Loyal3, liquidated each month and withdrawn to our bank account

So all in all that’s about $25,500 worth of manufactured spending capacity each month with nary a trip to Walmart. Not bad.

And here are my impressions of the current approach.

Isis Serve applications

The bad news is that in signing up my wife for her own account last month I discovered that you now get $15 from both Isis and AT&T, not $25 as when I had applied a month earlier.

The good news is that we got our $50 direct deposit bonus just by twice withdrawing $250 from our Amazon Payments account to our linked to Serve account via Amazon payments. This is much easier than having to do it through payroll at your work. It is also much quicker.

The Isis Serve account in general.

I love the Isis serve account. It is 10 times better than my old Bluebird account. How do I love it? Let me count the ways.

I shall read the following list in sonnet form….

- Loading $1500 a month directly and automatically online by credit card. (This is both more lucrative, and easier than Amazon payments.)

- Loading $1500 a month from my PayPal debit card directly and automatically online.(This is still quite easy and has the additional attribute of being a “double dip”- you get points for using your credit card to buy thE Mycash cards, and 1% additional cashback by liquidating them via the PayPal debit card.)

- Loading money pack cards online as opposed to going to Walmart to load gift cards – priceless.

- Being able to load $1500/day onto Isis Serve as opposed to $1000/day onto my old bluebird card.

- The one minor negative is that Moneypak limits you to $1500 loaded onto a particular debit card for a 24 hour period.(So you can’t load $1500 at 8:30 PM Pacific time, and then load another $1500 at 9:15 Pacific time because the Bluebird/Serve calender day rolled over at 12:00 AM Eastern time.)

Recent experimentation with rolling monthly credit card applications versus six card churns every three months.

It was worth a shot, but I definitely prefer the old method of 6 to 8 credit card applications every three months per Social Security Number because…

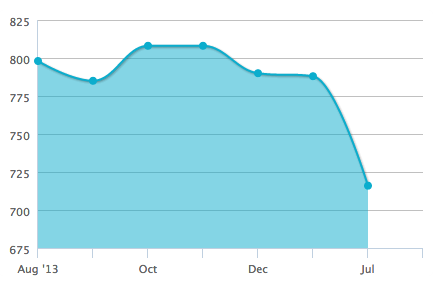

- I have noticed a steeper decline in credit scores with sequential month after month applications.(Though I expect this effect to be short-lived.)*

- I also don’t think this method opens up new opportunities for high bonus offers. After all if you were approved for Chase personal credit card last month you’re unlikely to be approved for another Chase Personal card this month. So if a sweet Chase offer comes up, you’re still locked out.

- Finally, as illustrated above I can currently manufacture over $20,000 in spending a month without much effort at all. This means that meeting bonuses on two cards or six cards at a time is largely the same thing to me.

Loyal3 hasn’t kicked me off yet.

- I keep on buying and selling stocks each month on loyal3.

- I’ve moved to buying them in batches of about 10 per day based on this article.

- Given the continued bull market I have yet to lose money on any given month.

- I continue to avoid buying stocks that have lost more than 2% the month prior so that I can tax loss harvest and avoid some taxes.

- Although this is the most labor-intensive part of my manufactured spending strategy, it is not annoying enough yet that I have put it on hiatus yet.

- It’s amazing how similar this ragtag collection of popular stocks is to the overall performance of the stock market. Serendipitous diversification, I guess.

Personal news from the last few months of playing the miles game.

- We are now the proud owners of two Southwest companion passes. One for me and one for my wife. This means we that as a family of five we can fly anywhere Southwest does for the cost of three tickets purchased with points, and less than 25 bucks total. Perhaps we will hit Aruba?

- Mrs. Dividend was approved for her second Citi Executive Aadvantage American Airlines card** which should net us our 300,000th AAdvantage mile in less than 3 months from this promotion alone (Almost enough for next year’s trip to Japan.)

- I’m starting to really look forward to my upcoming fancy trip to Vancouver BC, Taiwan, and Osaka next month. Such is the magnetic power of XLB (juicy Shanghai pork dumplings), Taiwanese beef noodle, and sashimi.

* This observation does not come close to rising to the level of solid evidence. It could very well be false attribution. Take it with several grains of salt.

** Sadly this offer is rumored to be dead. The best current offer is only 75,000 miles.

29 Responses to “Current Anatomy”