When I first started using “the PayPal axis,” it was for a very specific reason.

I had just signed up for the Softcard (then Isis) Serve card, and I saw that in addition to being able to load $1500 a month automatically using a credit card, I could also do the same with a debit card.

As a miles game player, this knowledge was akin to opium. If effortlessly manufacturing $1500 in spending a month (or double that if you add in a spouses card) was good, then effortlessly manufacturing $3000 ($6000) a month was really good.

And the way that I found to double this automatic manufactured spending opportunity was to use “The Paypal Axis” to convert credit card spending into debit card spending.

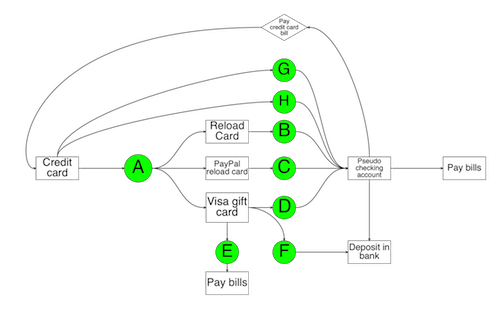

To take a step back here and orient ourselves, what I’m talking about within the world of manufactured spending, is going from step “A” to step “C” in the following chart:

So what does one need to access “the PayPal axis.”One really only needs two tools.

The PayPal business debit card

And

Paypal Mycash cards (purchasable by credit card.)

The PayPal business debit card

This is simply a debit card that draws upon the account balance in your PayPal account.

You can apply for it here.

And it has the following features:

- No annual fee

- 1% cashback on all purchases

- Ability to withdraw cash from your PayPal balance at ATM’s (for a fee)

The PayPal Mycash card

This is essentially a reload card that allows you to bump up your PayPal balance (as opposed to your pseudo-checking account balance.)

These have the following features:

- $3.95 activation fee

- You may load $4000/month using these on to your PayPal account.

- I have had luck purchasing these with credit cards at both Walgreens as well as Rite aid drugstores.

So the essential sequence of events in the Paypal shuffle goes something like this.

Step one: purchase $500 PayPal my cash card(s) with a credit card at a drugstore. (Fee $3.95)

Step two: load $500 balance on to your PayPal account online.

Step three: automatically load $500 onto your Serve account online ($5.00 cashback.) (Limit $1000 per month for Serve accounts, and $1500 per month for Softcard Serve accounts.)

Step four: Rinse and repeat.

So you can see that you actually make $1.05 for every $500 in manufactured spending using this method. It’s not much, but it is better than free.

It is worth mentioning that PayPal is fairly notorious within the manufactured spending community for shutting down accounts. I have never personally been shut down, but I did get a warning email when I withdrew money directly from my PayPal account to my linked bank account after loading it with Mycash cards.

So if I wanted to use this card in order to access my PayPal account balance without loading it onto my Serve account, the easiest and safest way to do so would likely be to purchase money orders with it. (but that’s a story for another day…)

At this point I would hate to be shut down, because this is a pretty powerful manufactured spending tool.

Such techniques that are better than free and scalable up to $4000/month are few and far between in my experience…

Questions and comments below please!

18 Responses to “Friend for Hire”