I recently copped to a breakdown. I decided not to continue to be a passive index fund investor merely rebalancing my slice and dice portfolio once per year.(Because smart money is so overrated.)

Instead I decided to jump off a cliff and go all in dual momentum.

My reasons were varied. It really was a spectrum. Everything from the greedy impulse to chase better returns, to the urge to fiddle with my own money, to the overwhelming desire not to lose big chunks of my retirement savings over short periods of time.

And in fairness, I did do a fair bit of due diligence before taking the leap. A bunch of back testing. Conversing back-and-forth with those whose opinion I trusted. Modelling. But in the end my path was clear. I just had to do it.

And so I did. Which meant I took my diversified 75:25 portfolio, replete with indexes of American large-cap, mid-cap, and small-cap stocks, international and emerging markets Stocks, REITs, and bond funds, and rolled it all over into a single low cost fund.

And then i nervously watched the stock market each day, waiting for a cosmic sign.

Now theoretically I knew from my back tests that it was possible to underperform the broad stock market for at least 10 years or so.

I also knew that tracking error made it quite possible to have inferior returns over two to four years in row (at minimum).

But knowing something intellectually and experiencing it in real time are two different things. So I was hoping for an auspicious start to my strategy.

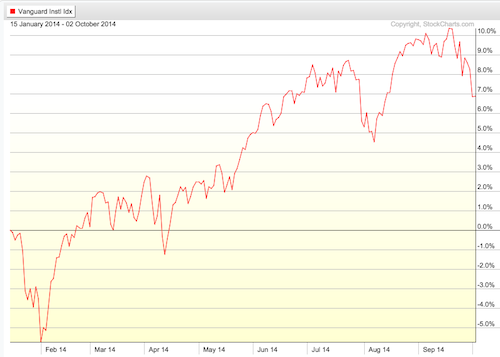

And so on September 15 I converted my entire much-ruminated-upon, well-diversified, modern-portfolio-theory-approved, retirement account into a simple one fund position. And by the rules of my adopted strategy the position was in VIIIX, (The institutional S&P 500 fund available through my retirement account.) I made the move just in time to see this happen.

Just another little blip…

Seen from a distance this was not such a dramatic series of events. It minor downward blip in the continual slow rise of stock prices overtime. To date it would not even be classified as a “correction.”

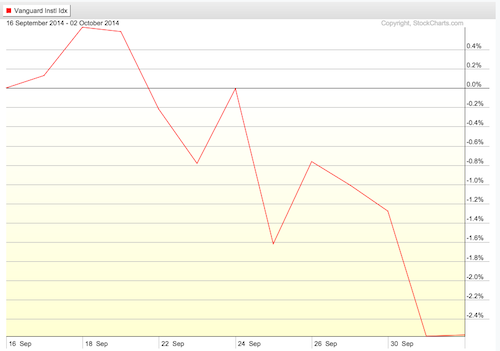

But over the time period in question it looked more like this:

Ouch…

Which still doesn’t tell the whole story.

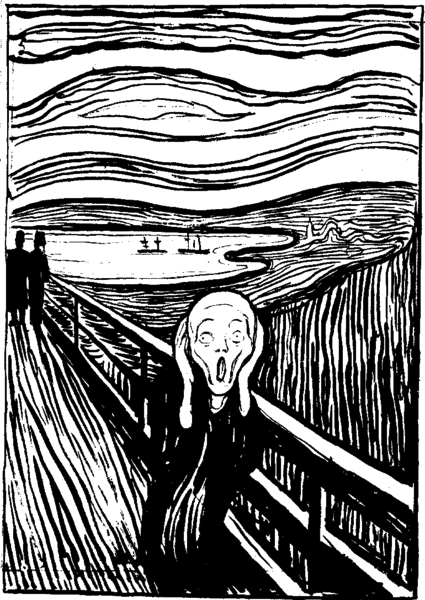

What I actually experienced was truly more like this:

The horror…

Day one: The stock market plunged more than a percentage point. Thousands of dollars of my net worth up in smoke. Perhaps tomorrow will be a better day….

Day two: Another bad day on the street. Thousands more dollars slipped through my groping fingers. Why must Putin be such an imperialist bastard? He’s ruining my plans.…

Day three: Good news at last, job numbers better than expected. Unfortunately this means that the market is afraid that the Fed will raise interest rates sooner than expected. Many more thousands of dollars down the drain….

Day 14: Damn these Hong Kong teenagers and their impudent demands for democracy. What the world needs now is peace and quiet. Enough principled non-violent protest. Enough Arab Spring. Enough instability. Because of this ceaseless unrest I will probably have to continue implanting pacemakers until I’m 85 years old.

(Which is to say it’s all been a bit of a baptism by fire.)

A concentrated stock position (even if it’s in an entire index fund) means way more volatility.

Put another way diversification allows you to usually have an asset that’s doing very well, and one that’s doing very poorly, and lots of positions in between. This means that even if emerging markets tank one day, the pain of the money lost will be diluted by the happy surprise that real estate did remarkably well. Blended together it means your portfolio will move up and down in smooth gradual movements.

Concentrated portfolios are more binary. Developments are either really good or really bad. And when news is really bad multiple days in a row, You can actually see your wealth (read future freedom) shrink. In such circumstances it’s surprisingly easy to picture your own economic collapse.

But here’s the thing. In practice this little stretch actually hasn’t been that hard.

And the reason that I say this is because my prime motivation for pursuing this strategy was its downside protection.

I wanted to avoid losing lots of money quickly.

I was seeking a margin of safety.

And experiencing these two bearish weeks right off of the bat has been paradoxically reassuring.

Had the market soared upwards I would’ve learned nothing.

But with the market jerking ever downward I was able to exercise my mental discipline muscles and remind myself that there could really only be one of three future outcomes.

Either the rapid descent would continue in which case in a month or three the prespecified strategy would demand that I retreat to the safety of short-term treasuries, thus stopping the bleeding.

Or the market would stick in this middle area for a while, in which case I would continue to invest at these now lower prices and collect relatively bigger dividends.

Or the market would rapidly recover in which case I would reclaim all of my lost money just as rapidly as I had lost it.

Which has all allowed me to sleep well at night, thank you very much.

Meanwhile my taxable account in Betterment moved downward with more gentle movements, (though down it still moved.)

But even those downward movements provided me with some good news. Betterment harvested $235 in tax losses from emerging and international markets! This should save me at least $115 in taxes next year. To put this in perspective the 0.25% expense charge by Betterment on my account should only be about $125 a year, so Betterment’s services, which I value highly, are practically free mere months after enrolling in TLH+.

Combined with the intrinsic tax efficiency of the Betterment portfolio, it’s extreme ease of use, and my consequent lack of desire to tinker with it at all, my account’s performance in the wake of this minor downward movement of the stock market, has really made me feel like investing in this manner is a “heads I win, tails I still win” scenario. Which is why I dumped another chunk of money into my Betterment account today despite the recent painfully bearish sentiment in the market.

So yeah. The bad news is that my timing sucks.

But the good news is that it probably doesn’t matter.

12 Responses to “I suck at market timing”