The concept of early retirement is a bit of an abstraction.

In a world where it is just assumed that everyone works until at least age 65, there are very few role models around you.

So it takes a bit of imagination.

And how do you move from the abstract to the palpable?

What was helpful for me was figuring out my current savings percentage.

If you would like to play along with me, go gather a paystub, or last year’s W-2 form/tax return.

Assuming you don’t get any bonuses, your paycheck is perfectly stable, and your gross pay is less than $110,000 a year, (the limit for the Social Security tax,) a pay-stub is just as good as last years tax return.

The values you’re interested in are:

1a. Contributions to all retirement accounts both by you, and your employer.

1b. Additional savings for retirement. (IRA, Roth IRA, Taxable retirement accounts .) These won’t be on pay stub.

2. The amount of principal (not interest ) you pay for your mortgage. You’ll need your monthly mortgage statement for this month or last years IRS form 1098 If you’re doing your income calculation based on Last year’s W-2.

3. Your gross pay.

4. The total amount of all taxes taken from your paycheck. (Federal income tax + state income tax + Medicare tax + Social Security tax+ any other extraneous municipal and/or state taxes.) These should all be totaled up on your paycheck and/or W-2.

Now divide the total amount saved by the gross pay minus taxes or…

1a+1b+2

3-4

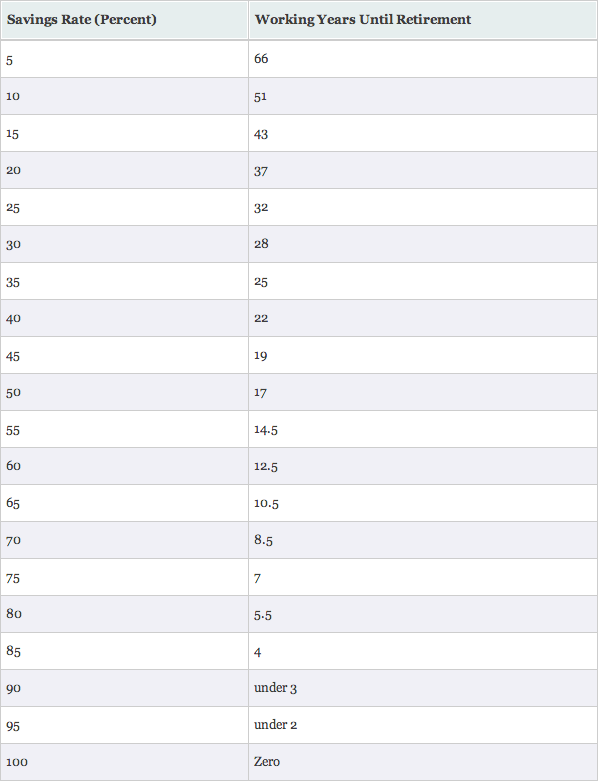

That’s where you stand right now. That’s the percentage to plug into this chart.

Now you should know how many years you’ll need to work at your current savings rate in order to retire at your current standard of living. (assumptions: invested savings grow at 5% real returns, in retirement you withdraw 4% of your savings per year, and your house is paid off by the time you retire)

As an example if your savings rate is 50% you need to work 17 years prior to achieving financial independence.

Now add 10% to your current savings rate.

How many fewer years would you need to work before achieving financial independence with this additional 10% saved? ( look at the chart.)

As an example at 60% of your take home pay saved you need to work 12 1/2 years prior to retiring. So a 10% Increase from your prior savings rate of 50% buys you four and a half years of financial independence.

Now take 10% of your gross pay minus taxes (0.1 X (3 – 4))from the above equation).

How much is that dollar amount per year, per month, or per week?

What would it take to save that additional amount? What would you have to give up? (Cable TV?, Starbucks?, eating out less often?, cigarettes?) Would it be worth it in exchange for the number of years of gained financial independence based on the above chart?)

For me the answer is obvious. And I just decided to kick my savings up another 10%.

Note: the gentleman pictured in the title photo for this post is Grigory Perelman.

He is the reclusive Russian math genius who won the Fields Prize, the mathematics equivalent of the Nobel prize, for solving a centuries old previously unsolved math equation.

When he won, he refused the $1 million prize which I think proves two things.

1. This guy is way smarter than you or I, and by his calculation, money is not that important.

and

2. Smart people can make stupid financial decisions.

5 Responses to “I Was Told There Would Be No Math”