One important question to address about early retirement is; What are the assumptions?

When I claim that if someone with zero net worth saves 50% of her take home income over 17 years, that she will at that point be financially independent, what does this statement rest upon?

One assumption is that the invested money will make 7% before inflation each year. This is a pretty conservative estimate based on past returns.

I’m also invoking the 4% rule. This is probably a safe percentage to withdraw yearly from an invested sum of money without running out of money in 30 years or longer.

The 4% rule’s underlying assumptions are:

1. Your investments will average out an annualized return of 7%, and there will be 3% inflation.

2. It is also assumed that you have no other form of income including Social Security, pensions etc.

3. You will inherit no money.

4. Your expenses will neither go up nor go down (taking into account inflation.)

5. You will rebalance your account once a year.

This concept is, parenthetically, a powerful way to understand how saving a greater percentage of your earned income dramatically shortens your time to retirement. By shrinking your needs and expanding your savings you’re pulling your finish line closer to you with each dollar you save.

Marathon: The toughest 13.1 miles you’ll ever run.

So that being said, let’s look at how a sample portfolio would have done over the prior decade.

Why the prior decade?

Because it was a historically bad decade. It included the dot.com bust, 9/11, and the worst financial crisis since the Great Depression.

So one could think of portfolio performance during the 2000’s as a stress test. A worst-case scenario.

In order to do so, I would like to call your attention to this excellent article by Rick Ferri.

http://www.rickferri.com/blog/investments/withdrawing-from-a-passive-portfolio/

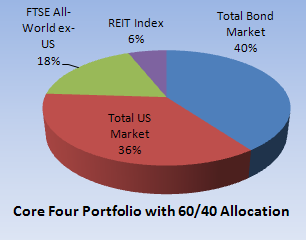

In it he back tests his Core 4 portfolio with different proportions of bonds to stocks.

This portfolio is Rick Ferri’s version of a “lazy portfolio.” A simple four fund portfolio that adheres to the principles of diversification in low-cost index funds.

He compares $1 million portfolios ranging from very conservative (20%stocks/ 80% percent bonds,) to very aggressive (80% stocks/ 20% bonds.)

He also compares withdrawal rates from 3% per year to 6% per year.

His results are found in this PDF, which you can open in a separate tab if you want to play along.

http://www.rickferri.com/blog/wp-content/wpuploads/2011/04/20110427_Withdrawals.pdf

As one might expect with such a volatile decade, the best returns were found in the most conservative portfolios.

For a decade like the 80s or the 90s The opposite would’ve certainly been true.

Let’s take a look at the 50% bonds/50% stock portfolio. In my opinion this is a very reasonable allocation for a person who is in retirement, and living off of her investment income.

At a 4% withdrawal rate ($40,000 a year withdrawn,) this unfortunate investor, cursed with retiring in a miserable decade, only has $1,114,947 at the end of the fiasco.

Wait a sec. Am I telling you that the retiree ends up with $114,947 more than she started out with despite withdrawing 4% /year over 11 years during an awful decade for the stock market?

Why yes, I am.

But, she definitely lived through some gutwrenching times. At its lowest point, her nest egg got down to $783,174.

And remember that at that point, she was rebalancing her portfolio by pulling her remaining money out of her safe bonds and dumping it into her tanking stocks.

So she definitely deserves some respect!

And I must add a disclaimer that these calculations are based off of the performance of the indices, not the actual funds. But as these are some cheap funds, that negative effect over 11 years would be fairly minimal.

So the take-home here is that:

1: We should all save more money! (Why not divert another 100$/paycheck to your retirement account right about now?)

2: We should invest our money wisely in low-cost index funds and well diversified portfolios.

3: We should rebalance our portfolios at least yearly.

4: 25 times our yearly living expenses is a reasonable goal to have for determining when we’ve reached financial independence.

(If you’re a pessimist you can change this calculation to 33 times yearly expenses and plan on pulling out 3% per year in retirement.)