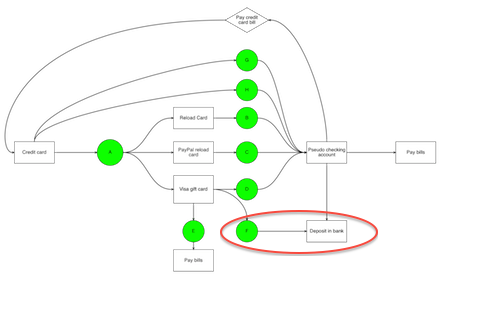

In the flowcharts that I have previously shared, and in my mind before there were flowcharts, the miles game was a labyrinthine map of intersecting roads, highways and thoroughfares.

The main interstate runs from the purchase of gift card/reloadables to the loading of the prepaid card, to the paying of bills with the prepaid card.

But aside from this main thoroughfare, there are lots of side roads, scenic routes, and diversions.

For instance the PayPal axis is like a pastoral country drive, replete with quaint delights (like better-than-free manufactured spending.)

How I feel about Paypal

And if that is true then today’s maneuver; leveraging money orders, is almost certainly like highway rest stops. Money orders are not the main event, but they are ubiquitous, and very useful, and when you need them, they are a godsend.

For those following along at home, in the grand scheme of manufactured spending, money orders reside here.

So what is a money order?

To quote the only source that matters: Wikipedia,

A money order is a payment order for a pre-specified amount of money. As it is required that the funds be prepaid for the amount shown on it, it is a more trusted method of payment than a cheque.

So it’s kind of like a cashier’s check without the bank.

And the way it works is….

Step one: you purchase a Visa gift card with a credit card.

Step two: you go to a big box store, grocery store, convenience store, post office… and you purchase a money order with some form of a debit card/gift card.

Step three: you make the money order out to yourself, and you deposit it in your own bank account.

Step four: rinse and repeat.

But there are other considerations.

Because of their ease-of-use, money orders are prime candidates for abuse by money launderers. Sufficed to say, manufactured spenders have no intention of laundering money, but it is better to never be suspected of such a thing.*

There are laws against depositing more than $10,000 in money orders in a bank account in a month, and of breaking up a large amounts into multiple deposits in order to avoid running afoul of the $10,000/month limit.

As an example, one cannot deposit $7000 one day and $5000 another day into a bank account in order to avoid being flagged as having deposited greater than $10,000 in money orders in a single month: this is an actual crime on the books known as “structuring.”

Consequences of the overzealous use of money orders could be bank account shut down, asset seizure, or even FBI investigation.

Here are some simple rules that I abide by in order to avoid running afoul of the law when using money orders. (These represent my own personal practices and represent no guarantee against you running into trouble.)

- I have never purchased more than $2000 in money orders at one time.

- I no longer deposit money orders into my main bank accounts, as I do not wish to have these at risk of being shut down.

- I would never deposit more than $2000 in money orders in a day, or $10,000 in a month into anyone bank account.

- I have opened a separate account simply for money order deposits.

In terms of this last point, when choosing a bank to deposit your money orders in, it is useful to know the playing field.

What you really want is a bank that will

A: Allow you to deposit money orders without any hassle or shutdowns.

And

B: Allow you to deposit money orders using mobile deposit (on your smart phone.)

And

C: Not have future lucrative credit card offers that will be out of your reach should your account be shutdown.

According to this wiki these are the banks which have capability to have money orders deposited into them by mobile phone :

- Simple

- Everbank

- Discover Bank

- TIAA bank

- UFB Direct

- Citibank

- Wells Fargo

- DFU

- USAA

- LMCU

- PenFed

- Eastern bank

- BBMT

(I encourage you to read the entire wiki for more details. )

So how can money orders be used?

- I have really only ever purchased money orders with visa/MC gift cards previously purchased by credit card.

- I have considered purchasing them with my PayPal Business Debit Card,(which would allow me to use the full $4000/month Mycash load limit…and even with the $.79/$1000 money order purchase fee, it would still be better than free.)

- It would seem possible to purchase them with a prepaid card (i.e. Redbird, Serve, Bluebird), Though I’m not sure why I would ever want to do that.

All in all money orders represent a nice little escape hatch that one can use anytime one gets stuck with a gift card that didn’t work for its original intent.

So maybe money orders are not so much rest stops as runaway truck ramps?

Who knows.

But they are exceedingly versatile…

Kind of like a swiss army knife nestled between a runaway truck ramp and a rest stop?

In any case the point is that they are damned useful (if you enjoy flying places for free.)

*To properly freak yourself out, (and become more aware of the possible risks of churning money orders,) read the entire comment section in this post, including the links.

11 Responses to “Miles Off Ramp”