If early retirement is a personal goal, then shopping probably can’t be your main hobby. If the idea is to whittle away at that which is unimportant, in order to focus on that which is important, then buying a bunch of stuff that you don’t need for the sake of fleeting moments of entertainment, really […]

Carpe Diem

One of the most common counter arguments I get when I discuss early retirement and the importance of the savings percentage with my friends, goes something like this: “My father died at age 36. What good would it have done him to save such a large proportion of his income for some retirement that he […]

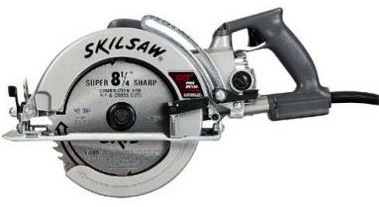

The Skills to Pay the Bills

I had always hated to pay my bills. Getting a thick envelope from the credit card company, the power company, or the phone company, had given me a slight sense of unease. I wanted to procrastinate, to put off the drudgery of sitting in front of the computer to dispense money to all of my […]

Do I Bore You With My Investment Talk?

I realize that just because investing is deeply interesting to me, doesn’t mean that it’s interesting to everyone else. Some people read investment theory books for breakfast lunch and dinner (i.e. me). But others’ eyes roll back at the mere mention of “compound interest.” Allocation? Don’t talk to me about allocation. I would argue , […]

Book Smarts

The Miles Game is really a three step endeavor. Step one: apply for a bunch of credit cards and accrue a bunch of miles. Step two: apply manufactured spending techniques to satisfy miles bonus spending requirements for each credit card. Step three: book awards to exotic locations with your accrued miles. We’ve already talked about […]

Bondage

We’ve now talked about all four factors that have been shown to correlate with higher returns in the stock market. The market (beta), value, size, and momentum factors; we’ve covered them all. It may have been a little bit econ 101, but it was probably necessary in order to frame the next part of our […]

Keeping Track Of Credit Cards

One issue that comes up when you start churning credit cards is how to keep track of them all. What do you need to keep track of? 1. When to pay the bills to avoid late fees. 2. Your progress towards meeting all of your minimum spend requirements in order to get your sign-up bonus. […]

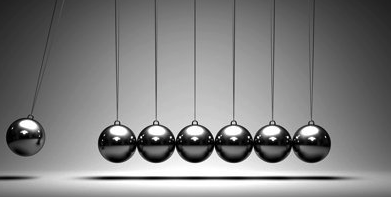

Inertia

Newton tells us that things in motion tend to stay in motion and things at rest tend to stay at rest. This law appears to hold for the financial as well as the physical world. In looking for different asset classes to combine to improve the returns of our portfolio, we’ve already discussed three of […]

On Bluebirds and Wolves

The first principle is that I must think about something new every day, and write something new every day and post something new everyday. The complicating factor is that I’m at a hotel in Medford Oregon tonight getting ready for a talk tomorrow. So this post will be less structured Than normal. Mea culpa. I […]

Small Packages

In the post the Value Of Value, we discussed the value premium. This classification is based on the observation that cheaply priced companies (low stock price relative to the earnings or asset value) outperform other stocks over the long-term. The size premium refers to the observation that over the long term small size companies outperform […]

Recent Comments