As we discussed in the post, money for nothing, The goal of manufactured spending is to spend money on cash equivalents (ie “nothing”) so that your spending rate goes up on your credit cards, enabling you to earn more points/miles. Stated differently, manufactured spending enables you to put every dollar of spending that you might […]

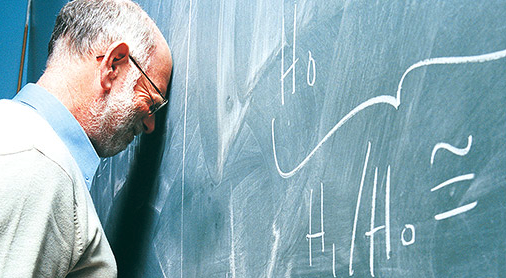

More Math

Note: the post here is just plain wrong! I have a more accurate approach to this issue here, please enjoy this one instead. I got a question today about calculating the number of years until retirement. The question was based on the posts, “warning this post may change your life,” and “I was […]

Untangling Miles

There a lot of reasons to play the miles game. Being able to go to exotic destinations in style for free is chief among them. It’s also one of the few endeavors that’s both cheap and luxurious. It’s quite simply a value added proposition. But it’s not a free ride. There are some monetary costs […]

The Value of Value

The goal is happiness right? And freedom. To that end we’ve already decided to kick up our savings percentage, and to take those savings and invest them. We’re probably going to invest in the stock market. And we’re definitely going to invest in low-cost funds. We’re going to rebalance our portfolios regularly, (knowing that it […]

War Of The Worlds

In general I see the miles game, and the pursuit of early retirement/financial independence as very complementary. (Obviously.) Early retirement is all about frugality. About making choices for freedom and against needless consumption. It’s about pursuing happiness. Early Retirement Dream House The miles game, on the other hand, allows one’s world not to shrink just […]

Low Hanging Fruit

If you’ve made the leap and are now the proud owner of six new credit cards, then what you’re likely feeling is a mixture of exhilaration at the thought of all of the miles (i.e. free travel ) you will soon own, and trepidation at all of the money that you must put on the […]

The Bookie’s Cut

When choosing an investment strategy, there’s probably nothing more important than focusing on the fees. We talked about diversification, and how it is the only “free lunch” in investing. We discussed rebalancing and how it allows you to repeatedly buy low and sell high. These aspects of asset allocation and investment behavior are incredibly important. But they’re probably […]

Confirmation

So after some honest self reflection you decided you were ready to play the miles game. You researched the best credit card offers and applied for 2 to 8 credit cards in a credit card churn. While you got for instant approvals for four cards, two approvals were pending at the time of your card […]

The Point

One could ask, why the obsession with financial independence? What’s so important about early retirement? Is work that bad? Is there some other project that needs to be attended to? This is a complicated question. But one worth thinking about. Personally, for me, the point of early retirement or financial independence is not simply freedom […]

Jedi Mind Trick

So you made the jump. You decided to perform a credit card churn. You’ve just completed six choice credit card applications and the world is your oyster. So what happens next? In all likelihood you will get some instant approvals, and some pending notices. In terms of getting your credit report checked with hard […]

Recent Comments