Let’s say you are starting a business. An unexpected opportunity is granted to you on day one, and you are given the ability, prior to investing a cent, to choose one of two business strategies. You may either: A: Buy high, sell low Or B: Buy low, sell high. Which would you choose? The answer […]

Money For Nothing

In “To Everything: Churn, Churn, Churn,” I made the comment that spending $17,001 in 5 months was “a piece of cake.” No doubt this sounded quite callous to some. After all the head of a household making $50,000/yr in Arizona (a low-tax state,) would take home $3500 a month in pay. This would necessitate that she […]

Free Lunch

In the post entitled risky business, we discussed the concept of “Beta.” This term defines the risk, or volatility of the market Itself. And with any individual investment, it’s generally true that there is no such thing as a free lunch. Put another way “No risk: no reward.” An equally important, and less obvious point […]

To Everything: Churn Churn Churn

If you have decided that you want to take the leap and get into The Miles Game, how should you start? To begin with make sure you’ve read the post entitled “The Miles Game” to see possible reasons why you shouldn’t get started yet. If you remain undeterred, the time has come for a credit […]

I Was Told There Would Be No Math

The concept of early retirement is a bit of an abstraction. In a world where it is just assumed that everyone works until at least age 65, there are very few role models around you. So it takes a bit of imagination. And how do you move from the abstract to the palpable? What was […]

It’s Business Time

When it comes to credit card applications, there’s tremendous upside to making some of your applications Business card applications. You may not think that you have a business, but I would bet that you do. When I say “Job Creators,” I’m talking about you. Within the realm of credit card applications, owning a business doesn’t […]

Risky Business

If you want to retire at a younger age than average, or if you want to live off your money by allowing your money to make money, then there are really two things that you must do as soon as possible. The first (and most important) is to kick up your savings percentage. And the […]

Birds Eye View

Before we get into the weeds about all of the particulars of playing the miles game (and we will get into the weeds,) it would be useful to look at the whole endeavor from a distance. We should answer some basic questions. Q: Why play the miles game? A: The reason to play the miles […]

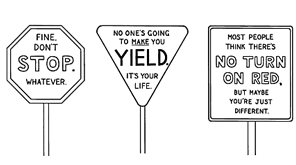

Passive Aggression

When it comes to investing, you’ve got to decide what camp you are in. Are you a market timer? Are you someone who believes in fundamental analysis? Do you believe in hiring experts who can do a better job than you? Do you believe in active investing? Or are you a passive indexer satisfied to […]

What’s the score?

As we discussed in The Miles Game one of the prerequisites for getting into the game at all is tracking and maintaining a good credit score. But how does one go about doing this? Well, the first thing to do is to get a free copy of your FAKO scores. Credit Sesame and Credit Karma give […]

Recent Comments