If you want to retire at a younger age than average, or if you want to live off your money by allowing your money to make money, then there are really two things that you must do as soon as possible.

The first (and most important) is to kick up your savings percentage. And the other, is to invest in the stock market.

Why the stock market?

Because the stock market has lucrative historical and expected returns.

And why does the stockmarket have such attractive historical and expected returns?

It’s called the risk premium. Essentially you’re being paid for the risk you take each time you invest in a business.

Think of it this way: if you were thinking about lending money to 2 people who both wanted to buy homes and you were choosing which person you would prefer to lend your money to, one with a high credit score would be a safer bet to pay you back than one with a low credit score. For this reason you’d expect a higher interest rate from the person with a low credit score in return for the risk that you were taking in lending the money. If you didn’t get this risk premium you would never choose to lend to the less attractive applicant in the first place.

I hear interest rates are low, uh you think you could lend me some bread?

I hear interest rates are low, uh you think you could lend me some bread?

Similarly stocks can display varying degrees of risk. Big stable companies that have been around for a long time like McDonald’s, are very unlikely to fold tomorrow. But a small internet start up is a riskier proposition.

For this reason you would expect to be paid more returns for investing in the riskier (class of) company.

But how do you measure the risk and returns of stocks?

Well, the returns are easy. You just look at the historical performance of any given stock or class of stocks to see what the average annual increase in value is.

But what about the risk?

The answer is Beta. Beta is a value that defines the risk of the entire stock market.

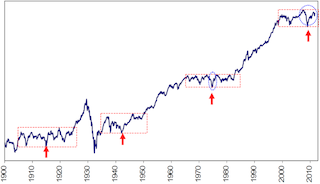

Historical performance of the Dow Jones Industrial Average

Historical performance of the Dow Jones Industrial Average

Over long periods of time the stock market pretty much always rises.

Dow Jones Industrial Average (last 1-2 months)

Dow Jones Industrial Average (last 1-2 months)

But over short periods of time we see that the stock market goes up and down in jerky and gut wrenching movements.

There are also periods of calamity such as the depression/financial crisis of 1930 and 2008 when the stock market falls as a whole by as much as 50%. (In the future it could be worse, who knows?)

Living through these periods is the price of doing business. It’s the risk that delivers the premium. Put another way, without this risk there would be no payoff in the end.

So if Beta is the risk of the entire stock market, and its value equals one, then any investment or class of stocks can be compared to the entire stock market and given a Beta value. If the value is greater than 1, then it is a more volatile or risky stock relative to the stock market (and one should expect a comparitively higher return on investment.) If the value is less than 1 it is a relatively less risky or volatile class of investments (and one should expect less returns on investment).

This is all pretty common sense. But there’s one more observation that isn’t quite as intuitive.

Volatility (risk) itself, over time, decreases the value of Portfolio returns.

As an example imagine two investments. They both have an average 0 % return on investment per year. Investment A has a standard deviation of 50, while investment B has a standard deviation of 0.

So investment A returns 25% one year and loses 25% the next year, while investment B returns 0% year after year.

Who has more money after four years?

Let’s invest $100 in each of these companies and find out:

Year one: Company A returns an additional 25% and has $125. Company B returns 0% and still has $100.

Year two: Company A Loses 25% of its value and has 93$. Company B returns 0% and still has $100.

Year three: company A gains 25% of its value and has $117. Company B returns 0% and still has $100.

Year four: company A loses 25% of its value and has $88. Company B returns 0% and still has $100.

So company A Is on a slow trajectory downwards, while company B demonstrates stable value. This is despite the fact that both companies have the exact same average annual return.

So this is an important fact to know about volatility (Beta) . It represents not only a psychological tax on the investor, but an actual cost to his (her) portfolio.

Which is where diversification comes in. But that’s a topic for another day…

Hat tip: this topic is covered in almost every investment book I’ve read, but I think Larry Swedroe’s book The Only Guide To A Winning Investment Strategy You’ll Ever Need, covers it the best.

The example of company A and Company B is taken directly from his book.