In the post the Value Of Value, we discussed the value premium.

This classification is based on the observation that cheaply priced companies (low stock price relative to the earnings or asset value) outperform other stocks over the long-term.

The size premium refers to the observation that over the long term small size companies outperform large-size companies.

This premium was worth an additional 3.8%/year returns over the stock market as a whole from 1927 to 2010. (Big money over the course of a long investment horizon.)

In general the smaller the company the larger than expected return over time.

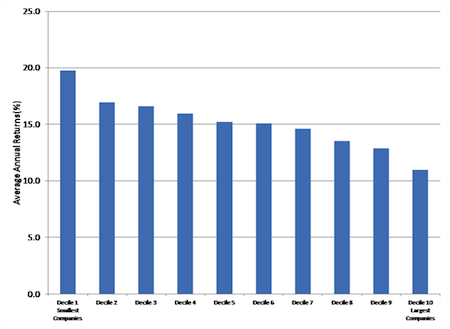

Witness this graph originally posted by Jared Kizer. From left to right; smallest to largest decile:

1. Over time, the returns of each decile of companies, sorted by size, increase with decreasing size.

2. The biggest bang for your buck is investing in the smallest of small companies. (Note how much better the returns were for the smallest decile compared to the second smallest decile. )

Small companies also have imperfect correlation to the stock market as a whole. So adding them to our other stock categories should increase the efficiency of our portfolio as a whole, thus boosting our overall returns even more.

Why do small companies have higher expected returns than large companies?

In the case of the size premium, it seems to be mostly a question of risk.

An investor in small companies is accepting higher bankruptcy risks, higher volatility (beta), greater chance of losses, and a greater chance of underperformance in difficult times.

Fortunately these risks are compensated with higher expected returns.

But beware small stocks. For within their midst exists a danger.

Yeah I’m small….Do I amuse you?

Small/Growth stocks are known as the “black hole of investing.”this class of stock has all the volatility and risk of small size. Unfortunately it has no additional rewards. Risk here is uncompensated, so it’s better left alone.

You’re better off putting your dime down on the small value category, which enhances returns with both the value premium and the size premium.

My favorite index fund in this category is actually an ETF, Guggenheim small value, stock ticker: RZV. It’s , relatively inexpensive, super small and Super valuey.

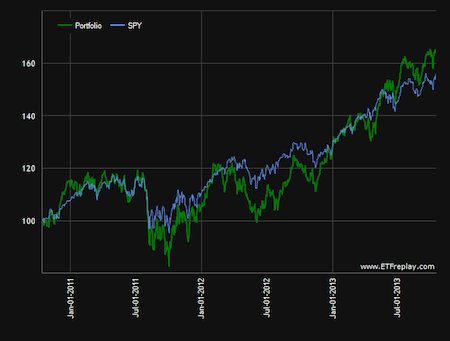

Charting the returns of this stock ETF against a generic S&P 500 ETF, really shows the character of the small value stock class. Tons of volatility, and higher expected returns. The lows are lower, but the highs are even higher.

Witness the past 5 years of RZV(small value-green) vs SPY (S and P 500 large blend-blue)

But don’t go blindly investing in this class of stocks.

Remember I’m only a doctor.

Read some books. I mean really, you should read some books.

Because there’ll be long stretches of time in the future when this class of stocks will underperform the market as a whole. And during those times you’ll probably want to jump ship. And if you do you’ll miss out on the rebound and all of the increased returns.

Don’t allow yourself to buy high and sell low.

Better to read some books and develop the intestinal fortitude to enable you to stick with your own hard-won convictions.