I’ve tried to be pretty Orthodox in my investment writing here, to date.

I think that most of what I write about investing could be successfully boiled down to a pretty boring list of 10 plain vanilla commandments.

- Save more of your own money and invest it.

- Invest your money in low cost passively managed index funds.

- When choosing a fund pay particular attention to the expense ratio. Keeping costs down is paramount.

- Spend a generous amount of time honestly thinking about your risk tolerance. The less risk tolerance you have the more cash/bonds should be in your portfolio. Better to underestimate your risk tolerance, then overestimate it.

- If you want to get creative, then tilt your portfolio towards those factors which have been shown to increase returns: beta, size, value, momentum, and quality.

- If you don’t want to be too creative simply buy cap-weighted indexes that mirror your own conception of the market as it currently exists. (lazy portfolios are a very good source of ideas for this sort of thing.)

- Diversification is a good thing, and is as close to a free lunch as you will find.

- Read a bunch of investment books and come up with a philosophy that is true to yourself as an individual.

- Once you have your plan, stick to it.

- Come up with an investment policy statement, and write it down.

And that’s really it. And evidence suggests that if we do those 10 simple things, we will outperform the vast majority of investors.

And the reason why I have focused on the simple messages, is that the main risk in investing is overconfidence.

If you think you can beat the broad market, you’re probably wrong.

The market is not perfectly efficient, but it’s efficient enough to make trying to beat it, a fools errand.

And keeping it simple, though it sounds very simple, is actually very hard.

But there are other things that I personally believe about the market.

Warning! These are the sort of things that are probably best ignored!

One of them that I will mention, (because it is in my own investment policy statement) has to do with valuation.

I’m not talking about evaluating single stocks, I’m talking about valuing the entire stock market.

One historical truth about the stock market, is that investing in it has been more profitable when valuations are low. (This is just a fancy way of saying that it is more profitable to buy into the stock market when stocks are cheap.)

So it doesn’t take a genius to realize that you have a good chance of doing better if you increase your percentage of stocks in your portfolio when stocks are cheap, and decrease it when they are expensive.

But how can you tell when the stock market is cheap or expensive?

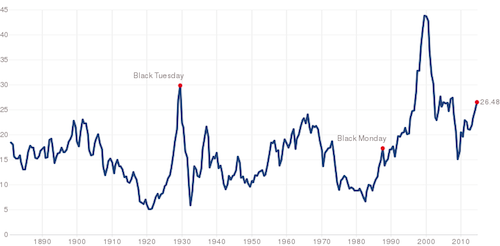

The most common method for evaluating American Stocks is the CAPE Shiller index.

This metric essentially averages the price/earnings ratio for the S&P 500 over a 10 year rolling average.

(The price to earnings ratio tells you how much you have to pay for a stock to get 1 dollar of corporate earnings. So it’s essentially a price tag, the higher it is, the more expensive the stock – or in this case the stock market.)

And here is a current snapshot of the CAPE Shiller Index

And from the snapshot you can deduce the following:

- The range of values is between 4 and 44.

- The average value is about 16.5.

- Bad stuff seems to happen when the value gets above 30 or so (but not always right away.)

- Our current valuation is well above average (26.48). (so the American stock market is currently relatively expensive.)

So Am I selling out of stocks and buying into bonds right now?

No I am not.

At this point I simply lack the tools to know when is the right time to divest myself from Stocks based on the CAPE Shiller index or any other market valuation tool.

But I have chosen a CAPE Schiller value of 30 to be the point at which I will decrease my allocation to stocks in order to avoid downside risk.

Unfortunately I do not have any convincing data to share with you concerning this strategy.

And it is important to remember how difficult it will be to divest myself from Stocks if and when we get to a CAPE Schiller value of 30. By that time the market will have been on a record run and I will have made a good amount of money in the bull market on the way up. So the last thing I will want to do at that point is to sell stocks and buy low yielding bonds.

But that is what I intend to do.

William Bernstein refers to this strategy as strategic asset allocation. More colloquially, he calls it “over-rebalancing” which is a good description of the psychological toughness it will take to implement it.

So let’s review. The strategy that I am describing is

- Poorly researched by this author

- Difficult to implement

- Overly complex

- Lacking convincing evidence to suggest future efficacy.

Which is why I have resisted writing about this for such a long time.

Let’s be clear, I am in no way suggesting that my readers follow my lead on this one.

I am explicitly suggesting that it would be smarter to scroll up to this top of the page and read the 10 Commandments again.

Keep it simple, stupid. Don’t be prideful. (You will probably be happy if you do.)

Perhaps I should follow my own advice?

Nah…This time its different.

19 Responses to “Stupid Human Tricks”