My central thesis in this series is that it is much wiser for investors to focus on the avoidance of losing money, rather than on making extra money in the market.

The first thing to say is exactly how not to do this. Which is to say, “whatever you do, don’t follow your gut.” While there may be some arenas were intuition is invaluable, investing is probably not one of them.

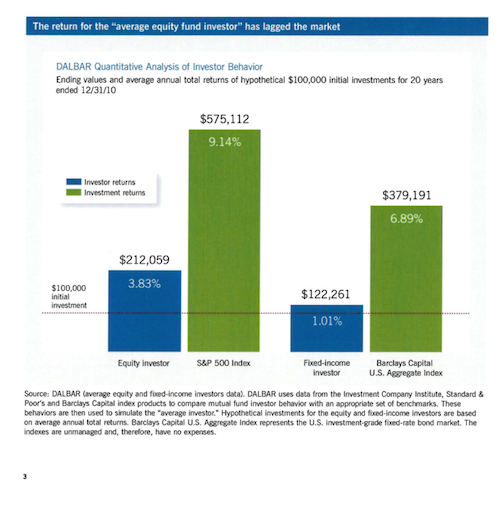

The results are in, and we investors tend to underperform the market by a longshot. We zig when we should zag, we get scared when we should be greedy, and we sell when we should buy. Which is why we tend to end up with results that look like like this.

To put it bluntly, our natural state is to suck at investing. So following our instincts is almost assuredly not a viable strategy.

So if we want to match or even beat the market, then the real question then becomes; how do we do this? How do we limit our chances of losing big?

Well, we begin at the beginning.

And by “the beginning” I mean low cost passive index fund buy-and-hold investing. This has been well covered territory, both in this blog and elsewhere. But simply put, the two most common ways to lose money while investing are with behavioral errors, and with unnecessary fees.

And passive investment in low-cost index funds is definitely an elegant way to avoid those unnecessary fees and possibly a way to avoid unforced errors.

To define my terms, what do I mean by passive investment in low-cost index funds? I simply mean doing the following.

- Determine your risk tolerance. (Here’s a hint, you’re probably less risk tolerant than you think.)

- Select a well diversified mix of low cost index funds that reflect your underlying risk tolerance, and investment philosophy, then invest.

- Rebalance your portfolio annually at a pre-specified time.

(And that’s really it.)

And how does such a simple approach prevent one from committing the unforced errors that make most investors massively underperform the indexes which we invest in?

Well it turns out that we are hardwired to be terrible investors. We humans are, as a rule both massively overconfident, and horrifically ill equipped to deal with financial losses. So if left to our own devices we are likely to invest in the following manner.

- We over-estimate our risk tolerance because we are focused on the rewards to be gained rather than the actual losses we are risking.

- We choose an investment strategy on the basis of it’s excellent recent performance. (not realizing that past outperformance usually predicts future underperformance because of mean reversion.)

- When our strategy begins to underperform, we switch courses in favor of an approach that has performed well more recently. (A.k.a. we sell low and buy high. )

- When there is a major bear market and we lose a significant amount of our portfolio, we are overwhelmed by the acute pain of losing money. (Sadly, prospect theory tells us that losing money is far more painful, then gaining money is pleasurable.)

- Overwhelmed, we then sell off our risky assets (like stocks) in favor of less volatile assets (like bonds). And in doing so we lock in our losses.

The buy and hold strategy’s chief defense against such behavioral errors is that (if performed correctly) there is quite simply very little that the investor needs to do. If the market goes up, he does nothing. If the market goes down, he does nothing. He simply rebalances once a year and does like Tony soprano.

Fuhgettaboutit.

Compare this to an active investor who must constantly monitor the market and make smart decisions. There are so many opportunities for unforced behavioral errors with such an approach.

Most importantly, active investment is more expensive than passive investment. Active funds almost always have higher expense ratios than passive funds and higher capital gains losses because of the costs associated with stock trading. And even the active trading of passive index funds tends to be tax inefficient and more costly given capital gains liabilities, and the friction of transaction fees and bid-ask spreads.

And for all of this increased cost of active investing, investors are rewarded, with 80% certainty, with returns that will consistently lose to risk matched passive indices over long (10 year+) time horizons.

Active funds: Sure they taste terrible, but at least they are fattening.

Unfortunately, although passive index fund investing is almost always cheaper than active investing, such an approach is probably not that much less prone to behavioral errors.

Sadly there is little evidence that passive investors are less likely to switch strategies and performance chase than active investors.

So how can we avoid these behavioral errors?

Honestly, I’m not sure, but here are some possibilities.

- Education: Reading about past financial crises, may alert us to vulnerabilities in our own portfolios before we face the stress of taking actual big losses.

- Back testing: testing our asset allocation against history can give us useful insight into our portfolio’s volatility and susceptibility to big losses. (Hint: We should try to focus on negative metrics like worst yearly loss, and maximum drawdown, to keep our eyes on the prize.)

- Automation: investing with a Robo-advisor that rebalances your portfolio for you automatically, or with a target date fund that does the same, means that you’ll never have to rebalance.*

- Be a wimp: Take on less risk in your portfolio than you think you can handle.

And the final (and most relevant) question is how to design one’s passive portfolio in order to minimize the risk of large losses.

And I think the key here is diversification.

In other words, in order to avoid the concentrated risk of holding only one or two asset classes, one can choose to include as many different asset classes as possible so that the underperformance of one asset class does not doom the entire portfolio to failure.

As an example, instead of investing in only American stocks one can invest in both domestic and international indices.

And instead of investing in just stocks and bonds, one can include real estate, commodities and precious metals, and cash too.

The most famous portfolio with diluted risk is the Permanent Portfolio** which includes:

25% equities

25% long-term treasuries

25% gold

25% cash (Tbills, short term treasuries)

This is the type of portfolio that rarely looks great, but almost never performs terribly.

There are always a good reasons not to invest in this type of portfolio. (Currently investors are none too excited about long term treasuries given the current low-yield environment, and gold, given its recent underperformance.) But such is the nature of true diversification. In order to minimize exposure to wealth degrading downside risks, one must own underperformers and poor prospects in their portfolio at most times.

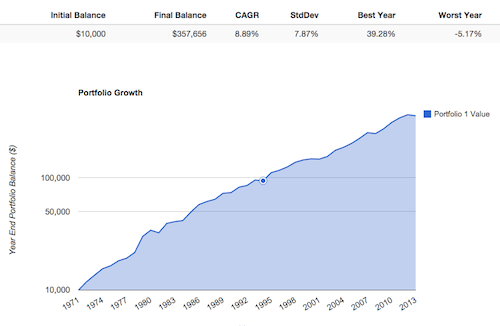

And the fact is that this portfolio has never had a drawdown of more than 5.17% during the 40 years since the US went off of the gold standard; a period which included hyper-inflationary periods, market bubble collapses, credit crises, flash crashes, recessions, and bear and bull markets.

Permanent portfolio performance

So why doesn’t everyone choose such a strategy?

Such a portfolio will have massive tracking error. In general when times are good, it will look very bad in comparison to a conventional approach. And despite the fact that we know that avoiding big losses is more powerful than achieving big gains, this sort of approach is just very difficult to stick with behaviorally.

Frankly, I doubt that I could ever stick with such an approach….

*This is my approach in my taxable accounts. I use Betterment with tax loss harvesting. Anecdotally, I find myself much less tempted to tinker with this account then with any of my other accounts because I simply have to do nothing to maintain a constant level of risk.

**I do not, nor have I ever invested in this portfolio. My mention of the permanent portfolio is merely as an example of a passive investment strategy which avoids big losses through aggressive diversification.

9 Responses to “The Coward’s Game: That Old Standby”