Convenience will cost you.

Want a Mac instead of a PC ? Prepare to pay 50% more for its ease-of-use and slick styling.

Want someone else to manage your money for you for a piddly 1% fee? Prepare to have a third less money by the time you retire.

Want to frequently roll through the drive-through on your way home for a McBacon bun, some fries and a Coke? If so you may also want to set aside a chunk of your money for the drug eluding stent that you will probably be needing to prop open your coronary artery at a later date.

And the miles game’s no different.

Although there are some near constants in the miles game like credit card churning, and the importance of planning ahead for redemptions, and gift cards, some parts of the game are forever in flux. (Particularly within the manufactured spending piece.)

Just this year alone we’ve already seen multiple changes to the miles game. Including:

- The death of vanilla reload’s purchased by credit card at CVS

- United, American, and Delta miles devaluations.

- American Express shutting the door on repeated approvals of The same credit card.

- Barclays tightening the reins on their approval process.

- Loyal3’s brief, but shining opportunity to buy stocks for free using your credit card.

Yes, that’s right. As predicted the Loyal3 window closed very quickly.

Allowing miles geeks to put thousands of dollars on their credit cards with with a few simple mouse clicks and no fees was strong catnip indeed for our kind.

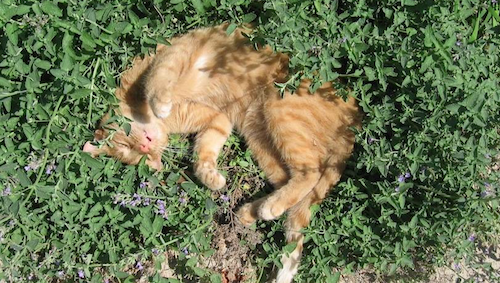

Free Miles: I could roll around in them for days

And so loyal3’s easy interface for churning burned brightly and was extinguished all too quickly.

To be clear, it is still possible to buy stocks for free by credit card through loyal3. You just can’t buy more than 50 bucks at a time using plastic.

And loyal3’s interface seems intentionally clunky to make such purchases less than efficient.

Don’t get me wrong I will probably ride this opportunity out with automatic $50 purchases of each stock on a monthly basis going forward. As long as it lasts this should translate into another free $2500 of spending a month with minimal effort. So along with Amazon Payments that’s an effortless $3500 a month in manufactured spending to offset mortgage payments etc.

But the bigger point here is that the miles game is quite simply not a set it and forget it proposition.

Manufactured spending is nothing more than the arbitrage of fleeting opportunities hidden within credit markets.

And by definition, such opportunities for you to gain value are necessarily paired with the inevitability of your counterparty losing value. ( I.e. the loyal3 opportunity was not truly a way for you to get miles for free, it was a way for loyal3 to buy your miles for you.)

Because of this necessary tax on the counterparty, inefficiencies eventually must be shutdown and the miles landscape must constantly change.

Which is actually alright by me for a few reasons:

- There are constantly new opportunities opening up in this pursuit.

- The most fun in this game is recognizing a new opportunity. This feels somehow creative and not like relentless drudge work. (As say loading a bluebird at Walmart can feel “drudgy”)

- This hassle selects those to play the game who truly enjoy it. (If it’s stressful for you to constantly figure out new angles on manufactured spending, you probably shouldn’t be wasting your time with it in the first place.)

- This selection of those who truly enjoy the game keeps these opportunities from dying out too too quickly.

Another much written about opportunity recently was the ability to buy Visa gift cards through on line portals from Staples online. This resulted in the possibility of better than free money (The holy grail of the miles game.)

Although I didn’t partake in this opening, it was clear from the get-go that this opportunity would be fleeting. And I’m sure Staples paid a pretty price for this one.

So I was not surprised to read today that Staples had renegotiated with online portals to shut down this online gift card loophole.

And I admit that what I’m saying is all a bit Pollyanna-ish. After all having an profitable opportunity shutdown is not really a good thing.

But the impermanence of the miles game landscape provides great soil for daydreaming. And this weekend I found myself considering future possibilities such as the as yet non-existent TD Ameritrade gift card. And even discussing the pros and cons of buying bitcoin with a credit card!

(Hat tip to John and Kaori for the bitcoin idea. I was intrigued but thoroughly unconvinced (a 7.5 % credit card purchase fee is usury… pure and simple. Steer clear!))

4 Responses to “The Impermanence of Miles”