The goal is happiness right? And freedom.

To that end we’ve already decided to kick up our savings percentage, and to take those savings and invest them.

We’re probably going to invest in the stock market. And we’re definitely going to invest in low-cost funds.

We’re going to rebalance our portfolios regularly, (knowing that it will be hard to do, but worth it.)

And we’re going to diversify, because diversification is cheap and delicious. (and rich.)

But diversify between what ?

Over my next several early retirement posts I want to talk about different factors within the overall stock market that have been academically proven to have higher that total stock market expected returns as well as varying degrees of correlation with the overall stock market. (both good things.)

In general stocks are classified by their size, and their value.

Size ranges from large capitalization to ultrasmall capitalization. (Capitalization being the total value of all of the shares of the company. )

Stocks are also said to either be value stocks,growth stocks, or blend stocks (in between.)

Value stocks have a cheap price relative to their market value, or earnings.

When I think of value stocks I picture a middle-aged accountant. He’s solid. Not flashy. He makes a good salary and saves a decent amount. His future appears predictable, stable, and maybe somewhat boring.

Conversely growth stocks are stocks that are thought to have big potential for future earnings growth. They also tend to have less income associated with them as they reinvest their profits to fuel more growth.

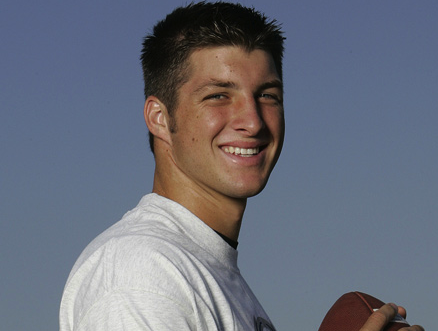

I picture a five star high school student athlete. Best grades in the class. Best looking girlfriend. Being fought over by athletic programs all over the country. Sure, he doesn’t make a lot of money now, but geez is he loaded with potential.

growth stock

It turns out that over long periods of time, there is increased return for investing in value stocks as opposed to growth stocks.

This is not to say that value stocks will always outperform growth stocks. During the tech boom in the late 90s, for instance, the opposite was true.

But value stocks over time have expected returns which are higher then one would project based on their beta.

Why is that?

The short answer is that no one really knows. But there are a lot of theories.

One theory is that value stocks are simply more risky and that this risk is somehow not reflected in their volatility (beta.)

Another theory, and one that I find more interesting, is that there is a behavioral angle. Namely that people investing in the market overvalue growth characteristics and undervalue value.

We all want to put our penny down on the future superstar. The winning lottery ticket. The next Facebook.

But for every LeBron James, there are five Kwame Browns. And for every Facebook, there are 10 My Spaces.

So maybe we should be tilting our portfolios more towards the slightly pudgy, middle-aged accountants and actuaries.

For some reason I find that thought very comforting.

Trackbacks/Pingbacks

[…] the post the Value Of Value, we discussed the value […]

[…] second principle here is Value. Both philosophically, and temperamentally, the idea that companies with a low price relative to […]