This is my final post in my “cowards” investment philosophy series.*

You will remember that the central thread tying this series together is the idea that when it comes to investing, not losing money ends up being far more powerful than making extra money in the long term.

To this end we have discussed aggressive diversification, risk barbelling, value investing, and trend following.

And today we get to my chosen strategy, dual momentum.

So what is dual momentum?

Dual momentum is a philosophy that uses two forms of momentum to increase returns in bull markets, and more importantly to decrease losses in bear markets.

The most widely appreciated form of momentum is “relative momentum,” which compares the performance of a number of assets, and invests in the one that has performed the best (in total returns) over a pre specified look back period. Such an approach capitalizes on the enduring observation that assets which have performed well in the near to medium term past, have a tendency to continue to do well in the near future.

Relative momentum has been shown to improve returns significantly in almost every type of market and every time period studied, going back to the 1700s. It is a robust pattern, referred to by Eugene Fama as “the premier market anomoly.”

But it’s not the sort of approach that minimizes losses. It’s more of a high risk high reward sort of a strategy.

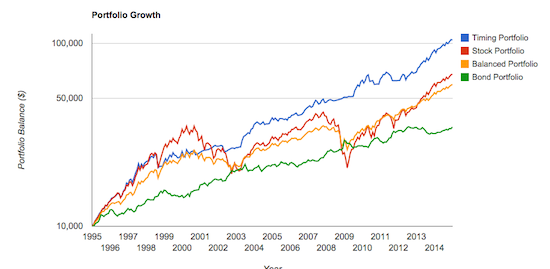

To illustrate this, let’s look at a simple relative momentum strategy toggling monthly between emerging markets, US, and foreign developed markets based on a six-month look back period.

Back test rules:

- 3 index funds (VFINX,DFALX,DFEMX) are backtested on the last day of each month.

- Best performing fund based on a 6 month lookback period is bought on the first trading day of the next month and held for a month.

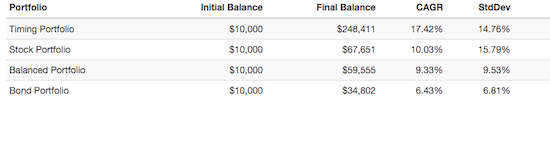

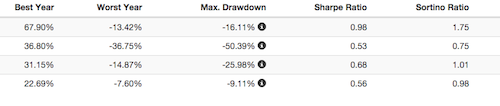

So the relative momentum portfolio outperforms the 100% US stock portfolio, but it does so at the cost of higher volatility, and larger drawdowns.

The other (And lesser-known) type of momentum used in dual momentum investing is “absolute momentum” or “time series momentum.” This approach also looks back at asset total returns over a set time period, but it doesn’t compare two or three assets, it simply compares one asset to a risk free asset (namely cash or short-term treasuries) and stipulates that any asset that has not outperformed cash over the look back period, should be sold and held in cash instead, until it’s losing trend has reversed. It treats the loser assets as the grimy outcasts that evidence suggests they will continue to be in the near term.

What smart investors think about assets with negative absolute momentum…

Absolute momentum is a terrific cowards play. Instead of getting the investor into the best possible assets at the best times, it gets him out of risky assets at the worst times.

And it works pretty well.

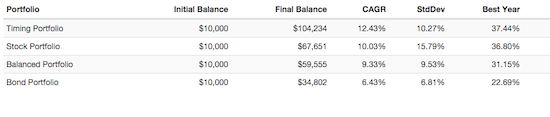

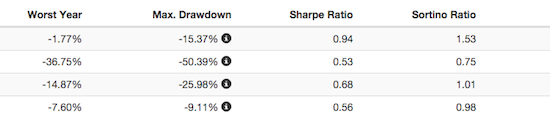

Let’s backtest an absolute value approach investing only in the S&P 500, (or short-term treasuries) based on a six-month look back period.

Back test rules:

- 2 index funds (VFINX,VFISX) are backtested on the last day of each month.

- Best performing fund based on a 6 month lookback period is bought on the first trading day of the next month and held for a month.

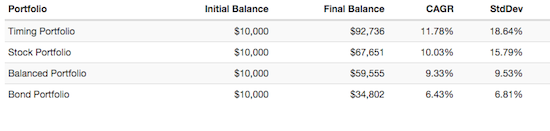

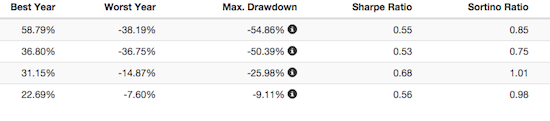

So these results are interesting, I think. The absolute momentum portfolio actually outperforms the S&P 500 by quite a bit. But it has much less volatility, and much smaller drawdowns. In fact, its max drawdown is even less than a 60/40 stock bond (“balanced”)portfolio. So this is really a low risk/high reward strategy.

This is actually a pretty similar strategy to trend following using the 200 day moving average that I previously wrote about here.

But absolute momentum has some distinct vantages over the moving average approach. In Gary Antonacci’s book Dual Momentum, he compares a 200 day moving average approach to absolute momentum and finds almost identical performance and Sharpe ratios (ie efficiency) looking back over a 39 year back test. But importantly, he finds that the moving average approach yields more trades (about 1.2 trades per year versus 0.83 trades per year using absolute momentum.) And in the real world more trades equal more costs both in the form of trading fees and in the form of the friction of bid/ask spreads. All things being equal, less trading is always better.

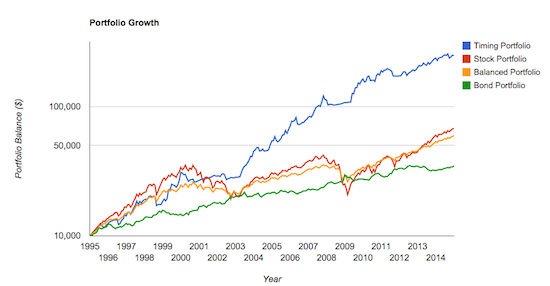

Dual momentum, as you’ve probably guessed by now simply combines relative and absolute momentum, to both harness the upside of relative momentum, and the downside protection of absolute momentum.

It sounds more complicated than it is. In fact to execute a dual momentum strategy, One need only start with a relative momentum strategy, and add short-term treasuries to the asssets in the lookback period. To illustrate this why don’t we add short term treasuries our initial backtest of emerging markets, and foreign and US developed markets.

Back test rules:

- 4 index funds (VFINX,DFALX,DFEMX,VFISX) are backtested on the last day of each month.

- Best performing fund based on a 6 month lookback period is bought on the first trading day of the next month and held for a month.

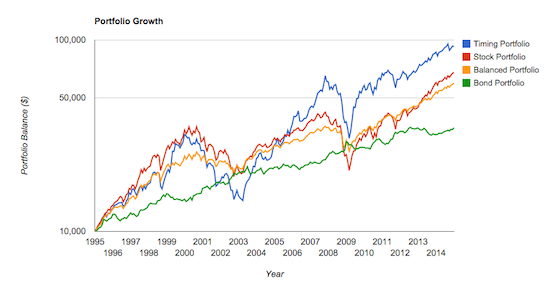

If you’re anything like me you find that result impressive.

And aside from past performance (and the caveat that accompanies it) there are many factors that appeal to me about this investment philosophy. (Which is why I have adopted dual momentum in my tax sheltered accounts. )

- Momentum is a bet on human irrationality, and a bet against that flavor of the efficient market hypothesis that posits that all individual humans are Homo Economicus capable only of making rational investment decisions. (I have yet to meet even one such human,so why would I bet on a collection of such humans driving the market?)

- The dual momentum strategy is essentially agnostic. As an example my friend Robert and I have gone back-and-forth over and over about whether it is wiser to be internationally diversified or not. But in executing the dual momentum strategy ones own biases become unimportant. If US equities have outperformed international equities (and cash) for the lookback period then the dual momentum investor will be 100% invested in US equities (and vice versa.) This rules based approach acts as kind of an irrationality filter.

- The dual momentum strategy is easy to implement , able to be executed using only low-cost index funds,and dependent upon only upon rare trading.

But the most important reason why I’ve chosen dual momentum as my go to strategy is simply this:

- I am a investment coward. And this strategy both avoids large drawdowns (a.k.a. putting your principal at risk,) and beats the market most definitively when the market is at its worst.

*I reserve the right to come back and write about out of the money options or some such hedging maneuver at some point in the future.

48 Responses to “Two Faced investing”